GE Aerospace sees supply constraints persisting next year

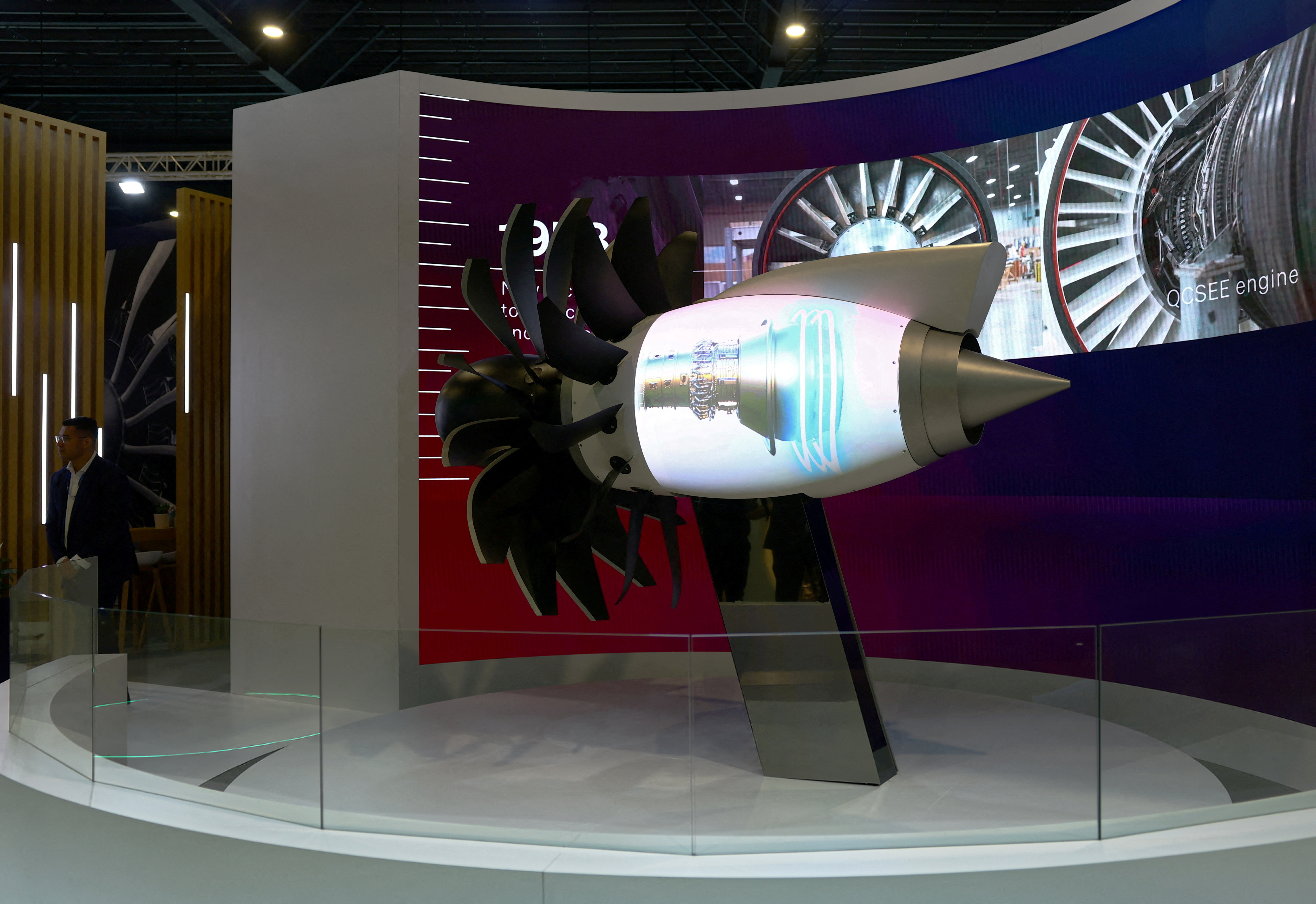

A view of the GE Aerospace booth during the Singapore Airshow at Changi Exhibition Centre in Singapore February 21, 2024. REUTERS/Edgar Su/File Photo Purchase Licensing Rights, opens new tab

EVENDALE, Ohio, June 19 (Reuters) - A GE Aerospace executive said on Wednesday global supply chains will likely remain challenged even next year, despite a production slowdown at Boeing

Russel Stokes, head of GE Aerospace's commercial engines and services, said while the company is aligned with Boeing's production rates for this year, it is working with suppliers to support a ramp up in production in coming years.

"I'm confident that over time things are going to get better," he said. "But...it's still a challenged environment for this year and probably next year."

GE Aerospace co-produces the engine for Boeing and Airbus narrow-body jets with France's Safran through their CFM joint venture, which is the sole supplier to Boeing's 737 MAX family of jets.

Boeing's jet production has slowed sharply as regulatory scrutiny has mounted since January when a door plug blew off an Alaska Airlines jetliner in mid-air. GE Aerospace has slashed estimates for LEAP jet engine production this year.

The slowdown could help a stretched supply chain catch up with demand, but there is also a risk of it further worsening the situation.

GE Aerospace CEO Larry Culp has attributed ongoing supply-chain challenges to the pandemic, which led to a plunge in air travel demand, forcing the aviation industry to lay off thousands of workers.

Supply chain problems have left the global industry hamstrung. They have not only made it tougher to increase jet production, but have also increased the turnaround time at jet engine repair shops.

Some airline CEOs have called engine repair delays a major constraint for the industry.

GE Aerospace, which became an independent company this year, has a dominant share in the engine market for narrowbody jets and enjoys a strong position in widebodies. More than 70% of its commercial engine revenue comes from parts and services.

Stokes said the company's equipment as well as services businesses are grappling with material availability issues.

GE Aerospace has deployed 500 of its engineers at suppliers and sub-suppliers sites and is using artificial intelligence to get around the bottlenecks, company executive said.

It now plans to deploy a technology, which is used to identify forged artwork, to detect chemical anomalies in metal parts. It is part of the company's drive to reduce overall turnaround time at its repair shops by 30% from a year ago.

Stokes said airlines want more engines to support their fleet. "We're doing everything that we can in support of that," he said.

Reporting by Rajesh Kumar Singh; Editing by David Gregorio